A lot of trend articles treat 2026 like a simple fork in the road: consumers either “trade down” or “trade up.” The 2025 data tells a more useful story. Beauty is still growing, but the rules of conversion have changed. People are buying, yet they’re asking harder questions before they buy: Does this work? Is it worth it? Is it safe? Is the brand credible? Can I see results or trust the process? McKinsey’s State of Beauty 2025 frames this shift as “consumer scrutiny of perceived value,” and it’s one of the strongest signals for what 2026 will reward: brands and service businesses that can explain, demonstrate, and defend value—with evidence, clarity, and experience design.

If you’re running a beauty brand, salon, spa, med spa, or distribution business, this is the most practical way to read the market going into 2026: not “what’s trending,” but what’s becoming non-negotiable in how people decide.

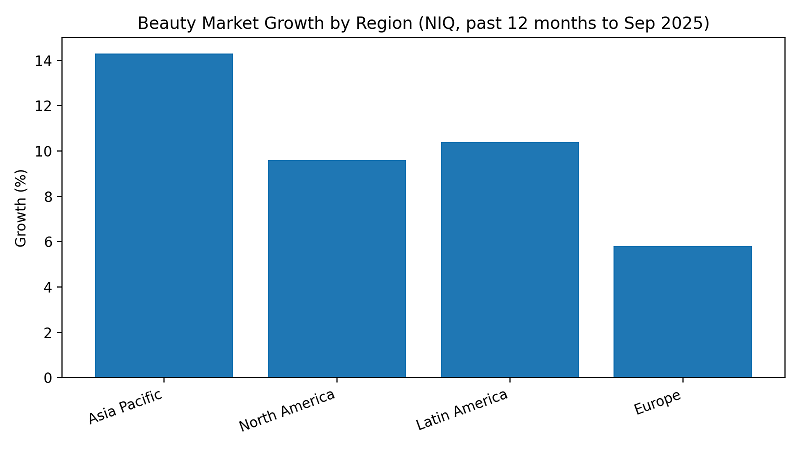

Start with the global picture. NielsenIQ’s State of Beauty 2025 reports that beauty sales grew 10% over the past 12 months, and it highlights a market that’s expanding while also fragmenting by region, channel, and consumer motivation.

That “10%” headline is important, but what matters more is how growth is being created: NIQ emphasizes digital acceleration and changing definitions of beauty (including wellness influence), which points directly to the operating conditions of 2026—faster trend cycles, more online conversion, and more demand for credible outcomes.

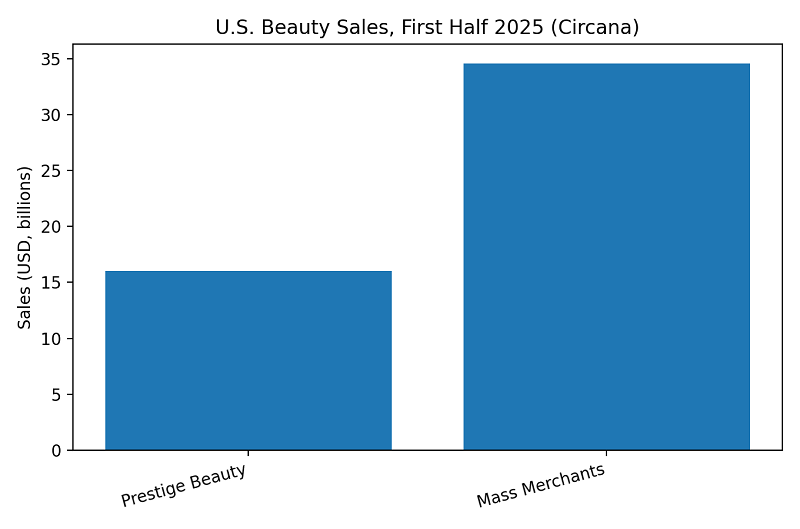

Now look at the U.S. because it illustrates the value dynamic clearly. Circana reports that in the first half of 2025, U.S. prestige beauty grew 2% to $16 billion, while mass merchants grew 4% to $34.6 billion. This doesn’t mean prestige is “losing.” It means that, in a tighter value environment, more volume shifts toward “high-performing at accessible price points,” while prestige needs stronger justification—innovation, brand trust, newness, or an experience that feels meaningfully better. Circana’s own commentary on value-based purchase behavior reinforces this interpretation: mass beauty is gaining momentum as consumers seek performance at accessible prices.

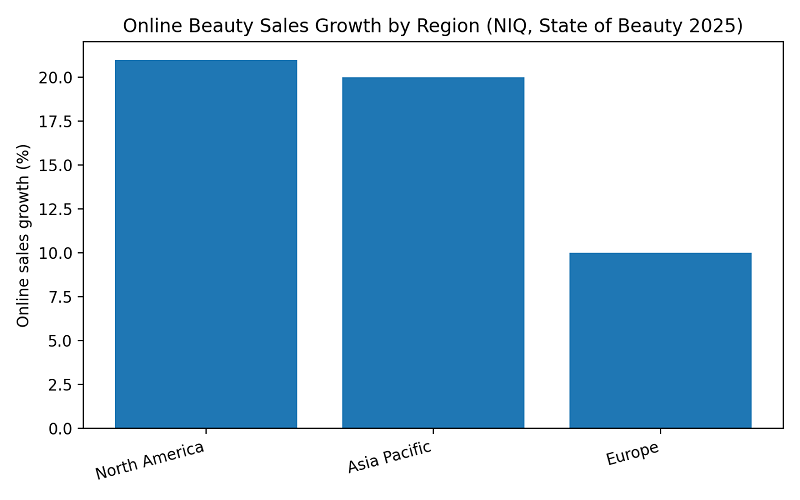

The third data point is the one most businesses underestimate because it sounds like a channel statistic, but it’s actually a decision-structure statistic. NIQ states that online beauty sales are growing nine times faster than in-store, with online growth of +21% in North America, +20% in Asia Pacific, and +10% in Europe. That implies something very direct for 2026: consumers are increasingly building confidence (or losing it) on screens. Your product page, your proof content, your reviews, your compliance signals, your service explanations—these are no longer “marketing.” They are the storefront.

The most useful way to define “value” in 2026 isn’t price. It’s risk reduction. When consumers feel uncertain, they don’t stop buying beauty—they change how they justify buying. McKinsey expects the global beauty market to grow around 5% annually through 2030, but it also emphasizes that growth is expected to be less price-driven than the inflation-heavy period that preceded it, with leaders anticipating deeper scrutiny of value for money. In practice, this pushes every operator toward the same question: Can you show why this is worth it before the customer has to guess?

In 2026, “value” will be communicated through clearer proof points and clearer expectations. For consumer products, that means brands that explain outcomes in plain language (what changes, how fast, for whom, and what to pair it with) will convert better than brands that simply claim “premium.” For service businesses, this becomes menu engineering: clients increasingly want either (a) a result they can understand and track, or (b) an experience they can feel is meaningfully restorative. If your treatment descriptions read like generic luxury copy, you’re asking the customer to trust without evidence. The businesses that win will build a simple evidence chain: consultation logic → service process transparency → aftercare clarity → maintenance timeline → real-world results or credible proxies for results.

This is why “value scrutiny” isn’t a vibe—it’s a structural change in decision-making. And it’s why 2026 rewards brands that become easier to trust, not just easier to desire.

Fragrance is not just a hot category; it’s a gateway behavior. Circana notes that in mass beauty, fragrance is leading growth, with sales up +17% in the first half of 2025, the fastest-growing beauty category in mass retail, and it ties the momentum to “dupe culture” and shoppers seeking accessible alternatives. (Source) That matters for 2026 because fragrance is one of the clearest examples of how consumers still buy indulgence in cautious periods—they just prefer indulgence that feels “worth it” and repeatable.

Once fragrance becomes a repeat purchase habit, it changes how consumers shop hair care, body care, and even services. In salons and spas, scent becomes part of experience design that can either deepen loyalty or support retail add-ons (travel sizes, layering products, scalp-care rituals). For product brands, fragrance momentum increases the value of discovery formats—minis, sets, sampling mechanics—because it lowers the risk while increasing the “fun” of purchase. In 2026, you’ll likely see more cross-category scent positioning: not just “this smells good,” but “this supports mood, ritual, and identity,” which is aligned with NIQ’s broader observation that beauty is breaking boundaries and connecting more tightly with wellness-style motivations.

The demand signal behind skincare doesn’t disappear in 2026; it becomes more technical and more integrated into routines. McKinsey notes that skincare will account for about 40% of the sector’s total market value, underscoring its role as the anchor segment even as other categories surge. What changes in 2026 is that the “treatment mindset” spreads further: people apply skincare logic to hair and scalp, and they adopt more procedure-adjacent routines (“tweakments” and post-procedure routine shifts are explicitly called out by NIQ).

For service businesses, this trend supports the continued growth of scalp care, advanced facials, and result-oriented wellness services—but it also increases expectations of professionalism. Consumers want to know what you’re using, why you’re using it, and what the plan is. For product brands, this supports hybrid categories: makeup with skincare benefits, haircare positioned as scalp science, and routines designed around “maintenance” rather than one-off transformation. In 2026, the best-performing operators won’t just sell a product or a session; they’ll sell a system the customer can understand and follow.

NIQ’s “online is growing nine times faster than in-store” line is a warning and an opportunity. It means consumers are increasingly forming intent in environments where they can compare instantly, leave instantly, and decide instantly. In 2026, the brands and salons that grow are those that build a screen-first evidence experience: clear positioning, strong visual proof, credible explanations, and frictionless next steps.

This is also why social commerce matters beyond “getting views.” NIQ explicitly frames social commerce as turning trends into transactions—because the discovery layer and the buying layer are collapsing into one. In practical terms, your content should not only attract attention; it should answer objections. The most effective beauty content in 2026 will feel like a short consultation: what problem it solves, what result to expect, how it fits into routine, who it’s not for, and what makes it safe or legitimate. Businesses that create that “micro-consultation” feeling will see higher conversion and lower returns, because they reduce uncertainty at the moment of purchase.

Regulation is becoming more relevant to brand trust—and in 2026, trust converts. In the U.S., the FDA’s MoCRA hub outlines modernization requirements and exemptions, while FDA guidance and resource pages explain expectations around cosmetic facility registration and product listing, including that manufacturers and processors must register and renew facility registrations every two years. Even if your customers never read MoCRA line-by-line, retailers, platforms, and professional buyers increasingly care about whether a brand can demonstrate legitimacy and process control.

For operators, this shows up as public-facing transparency: clearer ingredient communication, clearer safety/quality signals, and more structured documentation for B2B buyers. For service businesses, a parallel movement is visible: tighter scrutiny around who can perform which procedures, and how medical-adjacent services should be overseen. Texas, for example, enacted HB 3749 (“Jenifer’s Law”) regulating elective IV therapy in nontraditional settings like IV lounges, reflecting a broader emphasis on patient safety and supervision. The specific rule is less important than the broader pattern: 2026 favors businesses that can show they operate responsibly.( Source )

The practical 2026 play is simple: build trust assets into your website and your sales process. A short compliance page, clear shipping/returns, transparent warranty terms, and a “what to expect” section can raise conversion far more than another paragraph of marketing adjectives—because it reduces perceived risk.

If you want a data-backed view of service-side momentum, the American Med Spa Association’s executive recap reports that the total number of U.S. medical spas increased from 8,899 to 10,488, while average annual medical spa revenue increased from $1,307,587 to $1,398,833. Those two numbers together matter because they imply demand growth strong enough to support both more locations and higher average revenue—suggesting the market is not simply “stealing share” from itself.

For 2026, the takeaway isn’t “open a med spa.” It’s that professional aesthetics is becoming more competitive and more operationally sophisticated. As the space grows, consumers will compare more, expect more consistency, and rely more on social proof and credible standards. That pushes businesses toward better intake, better education, better client retention systems, and better differentiation (not by having “more services,” but by having a clearer promise and a more reliable experience).

If you’re building a 2026 plan, treat this as your guiding principle: make value visible and trust easy. The NIQ and Circana data suggests consumers are actively shopping performance and affordability, while McKinsey signals that the industry will grow but with intensified scrutiny of perceived value. So the best “trend” you can act on is building a stronger proof-and-trust pipeline.

That pipeline is not complicated, but it must be intentional. Your product pages should read like a confident expert explaining outcomes, not like a catalog. Your service pages should explain process and expectations like a professional consultation, not like a spa brochure. Your content should answer objections in public—safety, suitability, timeline, maintenance, results variability—because those objections already exist in the buyer’s mind, and if you don’t address them, they’ll leave to find someone who will.

Finally, build your “future-proof” categories around what 2025 proved is resilient: skincare as the anchor, fragrance as the affordable luxury engine, hair/scalp as treatment-adjacent growth, and digital-first conversion as the new baseline.

"*" indicates required fields